What are Staking, Liquid Staking, Restaking, and Slashing

Differing from Proof of Work (PoW), the Proof of Stake (PoS) consensus mechanism involves users locking funds to participate in a blockchain, where they ensure the verification and security of all transactions. The Ethereum network is one of the most prominent PoS networks.

Liquid staking service providers take user deposits, stake those tokens on behalf of users, and issue a receipt in the form of a new token, redeemable for the staked tokens. Liquid staking service providers like Lido Finance offer Staked Ether (stETH), representing an equivalent amount of ETH that has been staked.

Restaking allows users to stake the same tokens on the main blockchain and other protocols, securing multiple networks simultaneously. It can be viewed as leveraging trust within the PoS network. Tokens issued as a liquid receipt through restaking are known as Liquid Restaking Tokens (LRT), a concept pioneered and implemented by Eigenlayer.

Slashing is the penalty imposed when a participant behaves maliciously or goes berserk.

Eigenlayer

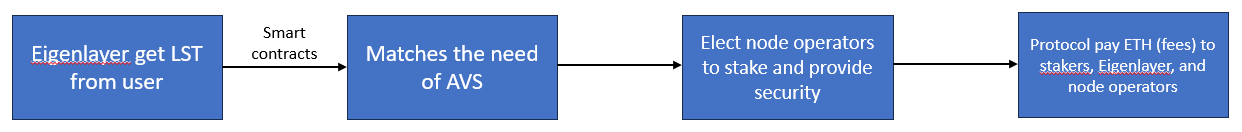

Eigenlayer serves as a platform connecting stakers and infrastructure developers, enabling stakers to earn increased rewards on Ethereum while providing validators with a means to secure multiple services. Simultaneously, developers can have their services secured and decentralized.

Eigenlayer offers two restaking options. First is native restaking which requires validators to operate their nodes, allowing them to choose which dApps to restake their tokens in. These dApps, seeking additional security infrastructure, are termed Actively Validated Services (AVS). AVS can be secured either by their native token or through permissioned access. In this case, validators need to download additional node software and impose extra slashing conditions.

On the other hand, liquid restaking involves stakers staking assets with a validator and receiving Liquid Restaking Tokens (LRT).

Through restaking, Eigen enables stakers to validate consensus protocols, Data Availability (DA), Virtual Machine (VM), keeper networks, oracles, bridges, and more. In short, Eigenlayer's pooled security establishes a decentralized trust market.

Why Ethereum?

Eigenlayer chooses Ethereum primarily because of its high density of validators, contributing to a more secure network. The decentralization of Ethereum serves as a key attraction for infrastructure development, as it establishes a high level of trust.

Furthermore, the relatively low price volatility of Ethereum is another factor that influences individuals to opt for restaking Ethereum over other options.

Market Fit for Restaking

In the context of Ethereum, the potential product-market fit for restaking encompasses all the Proof of Stake (PoS) chains within the Ethereum ecosystem. This includes:

Middleware (e.g. oracle, bridges, DA layer, and indexer)

Sidechain (e.g. Polygon)

Rollups

Benefits for Different Party

a. Liquid Restakers

Liquid restakers can enjoy higher yields (approximately 4% and above), as the elevated yield serves as compensation for undertaking additional risk. In the future, Liquid Restaking Tokens (LRT) could potentially offer expanded utility.

b. Developer

Developers typically need to establish their trust network by offering token incentives to attract users to secure their network. However, this approach not only results in high inflationary tokens that may induce significant selling pressure but also makes the network more susceptible to attacks when there is a high concentration of token holders.

Restaking provides a trusted network that leverages prominent Layer 1 platforms like Ethereum, eliminating the need for developers to bootstrap their security. The elastic security of Eigenlayer enables protocols to scale up or down based on demands, thereby reducing the cost of security.

Risks of Restaking

a. Additional risk from restaking

Restakers must bear the inherent risk of the Ethereum network, the risk of liquid staking, along with the risk of restaking. Any misbehavior in either party can result in stakers losing their entire stake.

b. Eigenlayer smart contract risk

The Eigenlayer is not battle-tested, and there could be bugs and vulnerabilities in the code.

c. Unintentional slashing

Different AVS have varying slashing conditions, posing a risk of slashing for honest validators. Therefore, Eigenlayer has suggested the establishment of a veto community that can vote to 'reverse slashing' until the network matures, coupled with security audits.

d. Concentration/Collusion Risk

When the Total Value Locked (TVL) secured surpasses the staked assets, it incentivizes validators to collude and engage in malicious activities. Eigenlayer proposed a solution that involves implementing a bridge to restrict value flow, an oracle to limit stakers' TVL, and self-monitoring capabilities by Eigenlayer.

Closing Thoughts

Restaking appears promising on paper, offering a higher yield, enhanced capital efficiency, and the ability to capture value loss. However, infrastructure elements like Eigenlayer and restaking protocols are not battle-tested. Numerous risks remain unresolved, and this could pose challenges.

It's important to note that restaking is not exclusive to Ethereum; protocols like Picasso are actively developing restaking solutions on Solana.

References

EigenLayer_WhitePaper-88c47923ca0319870c611decd6e562ad.pdf

Why EigenLayer Will Change EVERYTHING W/ Sreeram Kannan (youtube.com)

What Is Restaking and How It Enables Capital Efficiency | CoinGecko