Updated Analysis of Pendle Finance

Over the past 4 months, Pendle has achieved several milestones, including reaching $1 billion in Total Value Locked (TVL). This feat has placed Pendle among the top 20 DeFi protocols.

Since my previous post, Pendle Finance has increased its TVL by 780%, partly due to the emergence of Liquid Restaking Tokens/Protocols (LRTs). This growth has changed certain aspects of Pendle Finance's fundamentals.

Pendle Finance is the Uniswap of Interest Derivatives Market.

Some updates below,

Pendle remains the only platform for trading interest rate derivatives, where users can speculate on future yields. The recent surge in TVL had increased the barrier of entry for the new entrants.

Pendle's TVL grew from $100 million to $200 million in four months, and then skyrocketed to $1 billion in just two months.

This rapid growth can be attributed to the emergence of Liquid Restaking Finance (LRT). LRTs allow users to earn rewards on their staked assets while maintaining liquidity, attracting them to Pendle's innovative yield-generating features.

0 to 1 will be tough, but 1 to 10 will be easy.

DeFi protocols are increasingly looking to Pendle for its ability to significantly boost exposure.

Note: To be consistent, the period used will be from October 13, 2023, (when the TVL of DeFi market plunged to all-time low since the DeFi summer of 2020) to the present (February 14, 2024).

The Ability to Capture New Liquidity

Pendle's ability to capture liquidity grew significantly, rising from 0.45% to 1.78% over the past four months. While the overall DeFi TVL increased by $34.95 billion, Pendle captured $1.104 billion, representing 3.16% of the differences.

Pendle's recent success in attracting new capital showcases its expanding potential and solidifies its position as a major player in the DeFi landscape.

Pendle Still Undervalued?

While Pendle has seen an impressive 400% increase in the past four months, I believe it may still be undervalued. It is important to consider the broader market context. Bitcoin dominance has risen from 50.90% to 54.06% during the same period, indicating a trend favoring Bitcoin over altcoins (tokens other than Bitcoin). This trend is putting downward pressure on Pendle's price, despite its recent gains.

Another factor to consider is Pendle's market cap to TVL ratio. Historically, it has hovered around 0.40 to 0.50. However, in February, this ratio dropped to 0.25 due to significant increase in TVL. Assuming a return to a 0.40 ratio, this could potentially push Pendle's price to $5.05 (based on the current price of $3.35), representing a potential short-term upside of around 50%.

Note: Short-term trading is associated with significant risks.

Updated Catalyst

Onboarding of Liquid Restaking Protocol

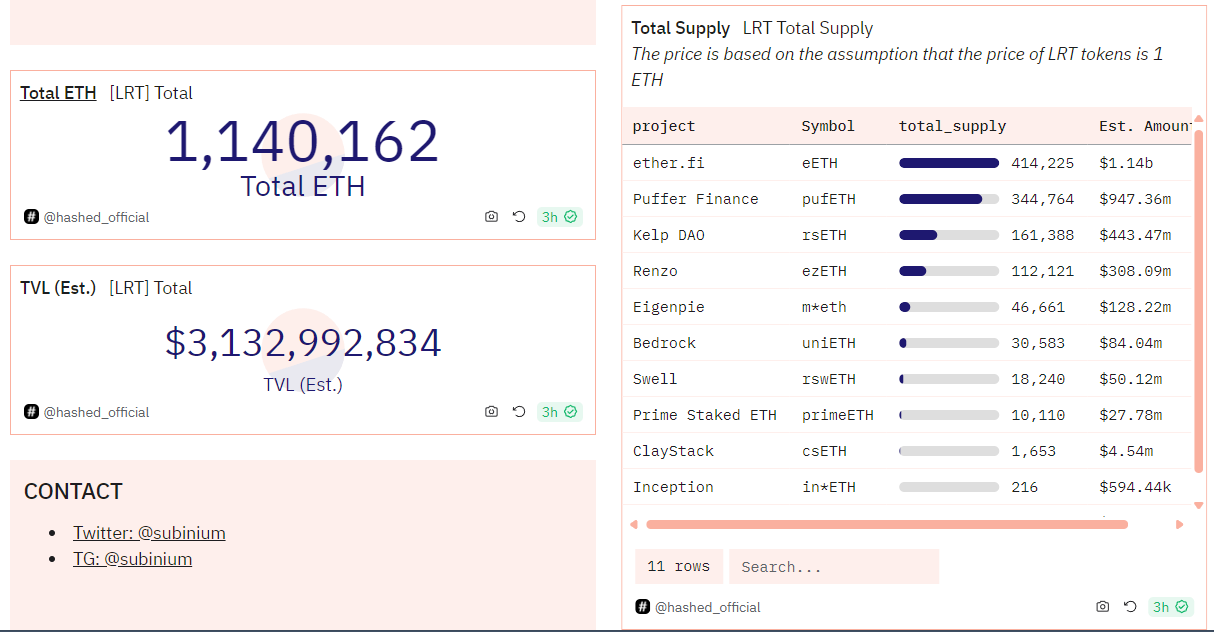

Pendle currently only onboards three liquid restaking protocols (Ether.fi, Kelp, and Renzo), leaving plenty of potential uncaptured as there are more than 11 on the market. The total liquid restaking protocol's TVL currently stands at $3.1 billion, or $6.6 billion if Eigenlayer is included.

Curent state of LRT wars, from Dune dashboard by @hashed_official. Expanding beyond these initial integrations, Pendle offers new products like wstETH (liquid stETH for Arbitrum) from Ether.fi and Kelp. This highlights the vast potential for growth within liquid staking alone.

Prediction: Puffer Finance, recently invested in by Binance Labs, might onboard its pufETH pool (worth around $1 billion) onto Pendle, another Binance Labs investment. This potential collaboration could significantly increase Pendle's TVL.

Pendle V3

There have been few keywords revealed about Pendle V3 like "intent" and "on-chain system for margin interest rate swap markets." Some speculate that "intent" might hint at potential collaboration with protocols like SYMMIO, which introduces a method for digitalizing bilateral Over-The-Counter (OTC) derivatives in a permissionless and on-chain manner.

Meanwhile, the latter enabling margin trading and larger swaps with minimal slippage, thus allowing institutional trading to have less impact on the prices.

DeFi Narrative

Pendle's ability to tokenize any yield-generating asset, exemplified by its recent success with liquid restaking, has significantly fueled its growth, highlighting its vast potential within the DeFi landscape.

Pendle Wars

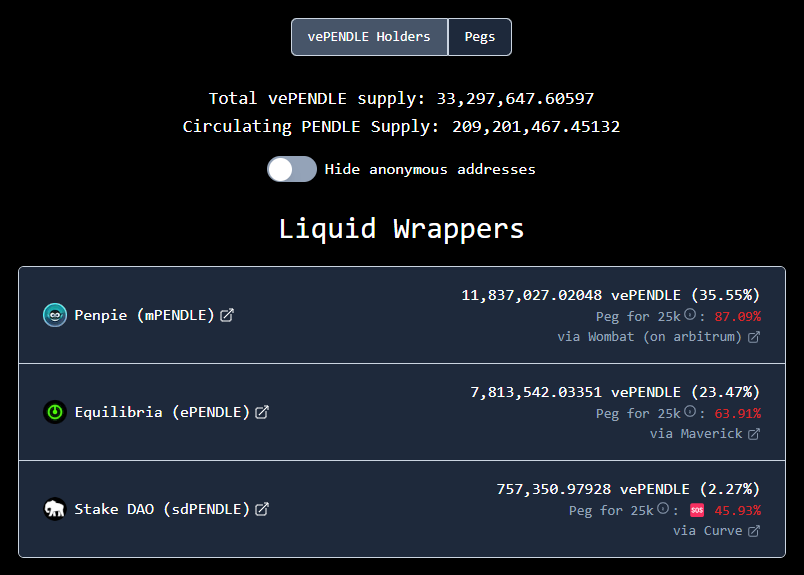

Current state of Pendle wars, from defiwars. Penpie and Equilibria has been actively engaging in Pendle wars, together they had obtained close to 60% of the vePendle supply. Together, they had accumulated a TVL of $446m where they allow users to earn boosted yield without having to lock up their Pendle token. Moreover, they are efficient in syncing their available pool with Pendle, giving the users to have instantaneous access to the latest pool on Pendle.

The continuous innovation on these protocols such as auto-delegating feature had showed commitment on protocols that build on top of Pendle.

Valuation

A new valuation method will be employed to enhance the accuracy of the valuation.

In a bull case scenario, assuming DeFi reaches its peak DeFi summer level of $179 billion in TVL, the current DeFi market still has an upside of $106.5 billion. Based on Pendle's DeFi TVL capturing ability of 3.16%, Pendle could capture at least $3.36 billion from this growth. This would bring Pendle's total expected TVL to $4.66 billion (including its current TVL).

Using $4.66b TVL as a reference, the price of Pendle could range from $12.06 to $23.71. A 0.50 ratio but sound unrealistic but it is achievable as the Pendle’s marketcap to TVL ratio for the past 7 months was between 0.40 to 0.50.

Risk

Native restaking carries inherent risks, such as slashing penalties, and potential security risks. Additionally, there are smart contract risk associated with Pendle itself especially potential security vulnerabilities in smart contracts, such as exploits or logic errors.

Closing Thought

Pendle holds a significant position in the DeFi market, and Pendle V3 is anticipated to be a major catalyst upon its launch. Moreover, Pendle does not have any competitor in the market and with more than $1b TVL, it is unlikely that any new entrant will try to dethrone Pendle.

This piece of article does not constitute any financial advice.